Peking University, April 26, 2022: Whether it is buying production materials, keeping close contact with regular clients in developed markets, or preventing business orders from being grabbed by rivals in Vietnam, almost everything is more costly, unreliable and challenging these days for Wang Chunsong, chairman of Color Star (Fuzhou) Products, an exporter of home decor in Fuzhou, Fujian province.

A worker prepares wind power equipment for export at the port of Lianyungang in Jiangsu province on Dec 31. WANG CHUN/FOR CHINA DAILY

Even though the company's exports, led by foreign countries' booming stay-at-home economy and consumption stimulus policies, kept growing throughout 2021, the export value fell by as much as 30 percent year-on-year to $17 million in the first quarter of this year.

Wang attributed this about-turn mainly to Color Star losing a number of old clients and its inability to cultivate new customers.

Surging prices of production commodities, rising shipping and power costs, the renminbi appreciation in the currency markets, and a 25 percent tariff imposed by the United States will make this year a tough one for many Chinese exporters who are struggling to survive, let alone make a profit, Wang said.

"Many US customers already told us that they used to purchase 70 percent in China and 30 percent in Southeast Asia. However, they said these two figures are about to swap in the future due to the tariff issues and their strategy of adding more manufacturers to global supplier lists. It has been disappointing news for us," he said.

In Guangdong province, which is to the south of Fujian province, Foshan-based Evergo Furniture Ltd, a sofa and bedroom furniture manufacturer, is feeling the pinch of fierce competition coming from Southeast Asian countries, especially Vietnam, Thailand and the Philippines, for international orders. On top of that, the declining consumption power in many developed countries has been driving the company's export volume down since July, said Zhong Sheming, its general manager.

To ease the pressure, the company began to develop its domestic market by building its own brands last year. It notched up 20 million yuan ($3.12 million) in sales revenue in the second half of 2021. Instead of just being an original equipment manufacturer or OEM, the company will foster its own brands via innovation and by catering to domestic consumers' preferences in the coming years, Zhong said.

The stories of Color Star and Evergo represent those of many other export-oriented companies in China. Chinese manufacturers who export goods ranging from sockets, decorations, shoes and induction cookers to electric hot pots and other products face the same issues-soaring raw material and shipping costs, weakening overseas demand for goods, pandemic and geopolitical headwinds.

"Although export orders are there, the profits are meager, and I feel panic when producing those goods," said Zhong.

China's foreign trade surged 21.4 percent year-on-year to 39.1 trillion yuan in 2021, and its exports and imports soared 10.7 percent year-on-year to 9.42 trillion yuan in the first quarter of this year. However, experts warned that excluding the factor of rising export prices, the actual export growth rate has been much lower than the growth rate of export value since the second half of last year.

"If the export price rises and the volume level is flat, the total export value will rise," said Yu Miaojie, deputy dean of Peking University's National School of Development.

If the prices of upstream products are high, it would mean the import prices would be high as well. So, although the average export price is relatively high, the difference between import and export prices is relatively small. Hence the profit margin of companies is limited, he said.

Chen Dapeng, vice-president of the Beijing-based China National Textile and Apparel Council, said it is difficult for Chinese exporters to refuse to accept new orders. If they do not take orders, regular customers will likely make a beeline for competitors. Many domestic companies have demanded a price rise for taking new orders, while many others are having second thoughts on this aspect because they see themselves as fairly replaceable.

To mitigate the pressure on exporters, the State Council, China's Cabinet, released a new set of measures in January to stabilize the country's foreign trade, a key driver of economic growth, to explore the growth potential of national imports and exports, and ensure unimpeded operation of industrial and supply chains.

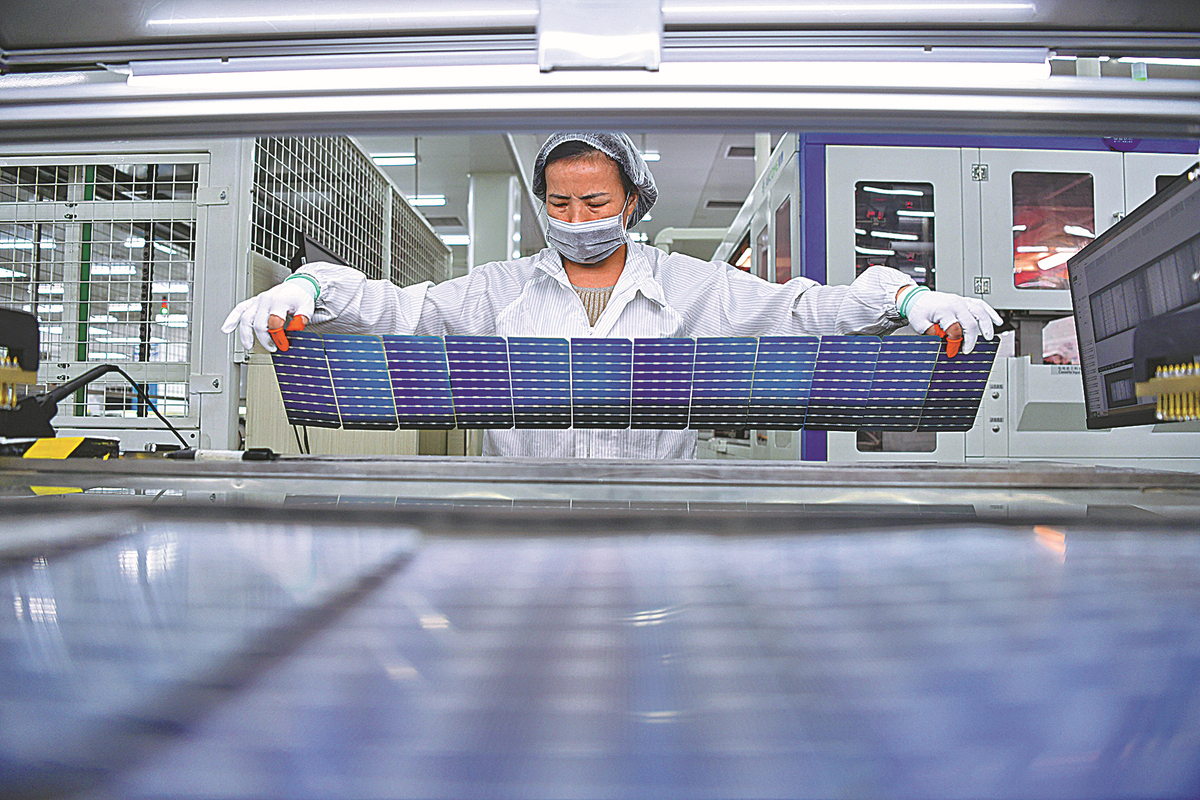

A worker processes photovoltaic panels at a factory of Akcome Optronics Science& Technology Co Ltd in Ganzhou, Jiangxi province, on March 22. ZHU HAIPENG/FOR CHINA DAILY

While stabilizing industrial and supply chains, the government sought to encourage businesses to sign long-term contracts with shipping companies and persuade financial institutions to provide inclusive loans to eligible micro and small businesses involved in logistics.

Local authorities have been asked to draft more support policies for labor-intensive sectors, especially textiles, clothing, furniture, plastic products, toys and ceramics, to stabilize their businesses.

Although overseas demand for goods is likely to weaken this year, China's overall export situation will remain stable. For, whether in finished consumer products or some intermediate goods, its manufacturing sector's size, and the quality and competitive prices of its output, are hard to match in the global market, said Deng Yu, a senior researcher at Bank of Communications' Financial Research Center in Beijing.

In terms of the structure of foreign trade, China now exports not only primary products but also a large number of high-tech and high value-added products like new energy vehicles, electronics, high-end trains and vessels, Deng said.

China's automakers shipped more than 2 million vehicles, including over 310,000 NEVs, to global markets in 2021, said Chen Bin, executive vice-president of the China Machinery Industry Federation in Beijing. With mature technology accumulation and well-established sales networks overseas, China's automakers will ship more NEVs with cruising power from 400 to 500 kilometers to foreign countries and regions this year, boosting trade, he said.

China's machinery manufacturing sector, pushed by its companies' continuous industrial upgrading, exported $676.5 billion worth of products last year, including clean energy equipment, construction machinery, auto parts and smartphones, jumping 33.7 percent year-on-year, according to the General Administration of Customs.

Since China's exports of stay-at-home-related products and pandemic prevention items notably dropped in the first quarter of this year, the exports of mechanical and electrical products, based on global market demand, will account for a larger share of China's exports this year, with a growth rate of 30 percent year-on-year, Chen forecast.

As China's exports are under the influence of a high growth base last year, it is difficult to maintain a high export growth rate this year, especially in the first half. Since the purchasing managers' index in many major economies has fallen, the global economy may have entered a downtrend, piling greater pressure on China's exports, said Feng Mohan, a researcher at Beijing Fost Economic Consulting Co Ltd.

So, Chinese exporters require help not only from macro policies such as exchange rates but also from supportive policies in the areas of logistics, financial services and business facilitation, he said.

Through policy assistance, the Ministry of Commerce started to work with China Export & Credit Insurance Corp in late February to give full play to export credit insurance's function in risk prevention and credit enhancement.

By stepping up the use of export credit insurance, the ministry will protect an exporter from the risk of nonpayment by a foreign buyer, and improve foreign trade companies' risk-hedging capability for two-way fluctuations in the exchange rate of the Chinese yuan to the US dollar, as part of its holistic efforts to stabilize market entities and spur foreign trade growth.

Besides pushing cross-border renminbi settlement with trading partners, it is vital for the government to accelerate the development of new business forms such as cross-border e-commerce and overseas warehouses, promoting the integration of domestic and foreign trade, as well as enhancing trade digitalization, said Chen Jia, a researcher at the International Monetary Institute of Beijing-based Renmin University of China.

Hu Dongmei, general manager of Dalian, Liaoning province-based Dayang Group Co Ltd, a large-scale exporter of made-to-measure suits with more than 4,500 employees, said the company's production plan until September has been scheduled, thanks to resumption of work in its pillar markets, including the US, Canada, Japan and the Netherlands.

Hu said the company plans to export products worth $180 million to $200 million this year, while deploying more resources to expand its domestic market and online sales channels, in order to seek new growth points and reduce the impact of surging material and shipping costs on its overall financial performance.